If you own a credit card, you must be aware of unauthorized charges. My friend got her last month’s statement, and she is complaining about an unknown Personpay.net charge on it. She asked me, and I immediately started looking for it.

In modern times, it is very difficult to distinguish between legitimate and scam transactions, as many companies use third-party payment partners to manage their sales. I contacted the card support team and ask more details about the charge and why it appears on her card statement.

In this article, I will tell you about what is Personpay.net charge on credit card and how to stop it from appearing on your credit card and bank statement.

What is Personpay.net Charge?

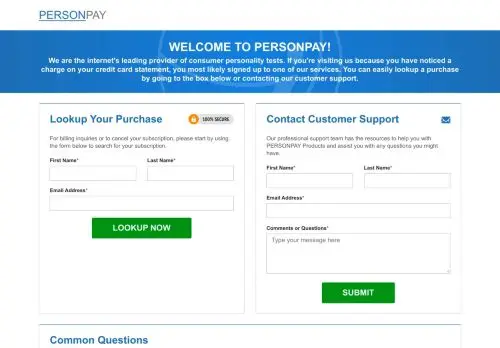

Personpay.net is a registered business website that offers services like mypersonality.net. It is a digital IQ test by Personpay that helps users learn more about their personality and enhance it over time.

IQ-score.org, mypersonality.net, and brainable.com are some of the best IQ test and quiz websites owned by PersonPay. PersonPay uses its own encrypted payment gateway. If you see a Personpay.net charge on your credit card statement, it is because you signed up on the above-listed websites using your card and took a personality quiz recently.

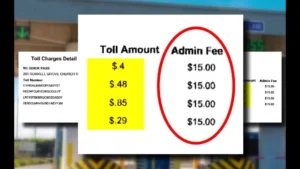

What To Do If You See An Unauthorised PersonPay.net Charge?

As you are signed up for the quiz or test, it is impossible to get a refund as these websites don’t offer refunds, but you can simply cancel your Personpay.net membership by visiting their website or emailing them at support@athpay.net.

If you don’t recognize the transaction, ask your friend or family about the transaction; maybe your family or friend used your card to access personpay.net. If not, contact your card service provider and tell them about the unauthorized transaction, raise a chargeback, and block them immediately.

According to user reviews, Personpay.net is a legitimate website. The charge only appears on your bank and card statement after a verified transaction. If you don’t recognize the charge, your card details may be compromised. Ask your family member about the transaction, and even if you don’t link the transaction, then you should contact your bank, ask them about the fraudulent transaction, raise a chargeback, and block your card immediately, as it is a sign of potential fraud.

Conclusion

Credit cards are lifesavers, but unauthorized charges are a headache. One mistake and the scammer has taken out all your money. Stay safe, and don’t share your card details online and on unknown websites.

If you have a credit card, here are some charges that you must be aware of:

What Is Cfran Charge On Credit Card?