I am a Financial manager for all my friends and family members. Whenever they find an unknown charge on their credit card and bank statement they immediately call me to ask about the charge and whether it is legit or not.

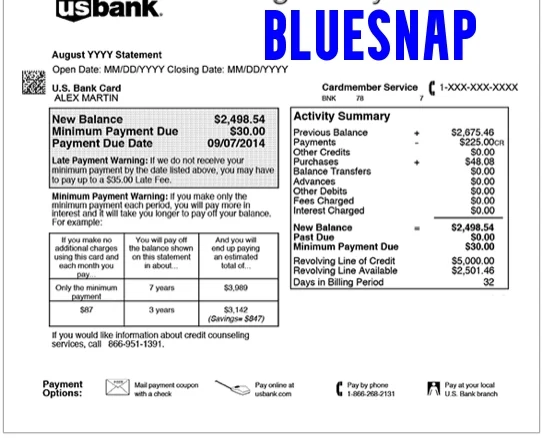

This time, a friend asked me about the BlueSnap charge on her credit card. I immediately started researching it. I contacted credit card customer care and asked for more details about the charge. Then I came to know about the BlueSnap charge and why it appeared on your credit card statement. So, in this article, I’ll explain everything about the BlueSnap charge on credit card.

What Is BlueSnap Charge?

BlueSnap is a global payment orchestration platform that helps businesses fulfil all their payment needs, including online and offline payment solutions. BlueSnap is changing the eCommerce sector completely, as its RoI-driven solutions work well for small businesses, too.

More than 150+ businesses in the US and globally use BlueSnap for their payment wall. If you see BLUESNAP or BLS on your credit card statement, then the payment is processed by them.

You can contact BlueSnap at (866) 312-7733 and ask about the exact details of the store from your shop.

What To Do If You Notice An Unauthorized BlueSnap Charge?

Now you understand why you see a BlueSnap charge on your credit card or bank statement. But if you still don’t recognize the charge, it may be a sign of fraud or that your card details have been compromised. You should contact your card provider and block your card immediately.

Conclusion

Staying on top of the finances is very important nowadays. When we ignore these small unauthorized transactions, a big scam can happen. So, always go through your statement every month thoroughly. And if you hold multiple cards, then you should be aware of these charges:

What Is Consumerinfo.com Charge On Credit Card?